Customs Update for Shippers

.png?ver=2021-10-26-142105-183)

Updated October 2021

Great Britain left the EU on the 1st of Jan, 2021. Declarations are required for all goods coming into or out of the Republic of Ireland to/ from Great Britain.

Please tell your consignee to expect SMS and Email communication from DPD with their Predict 1 hour window for delivery once their parcel is in the UK delivery network.

We are also receiving parcels from customers that cannot be shipped onwards to GB as they do not have the required customs information. These will be returned to you. Remember that shipments travelling from Republic Of Ireland to Great Britain require full customs' information.

3 easy steps to ensure that you are customs-ready:

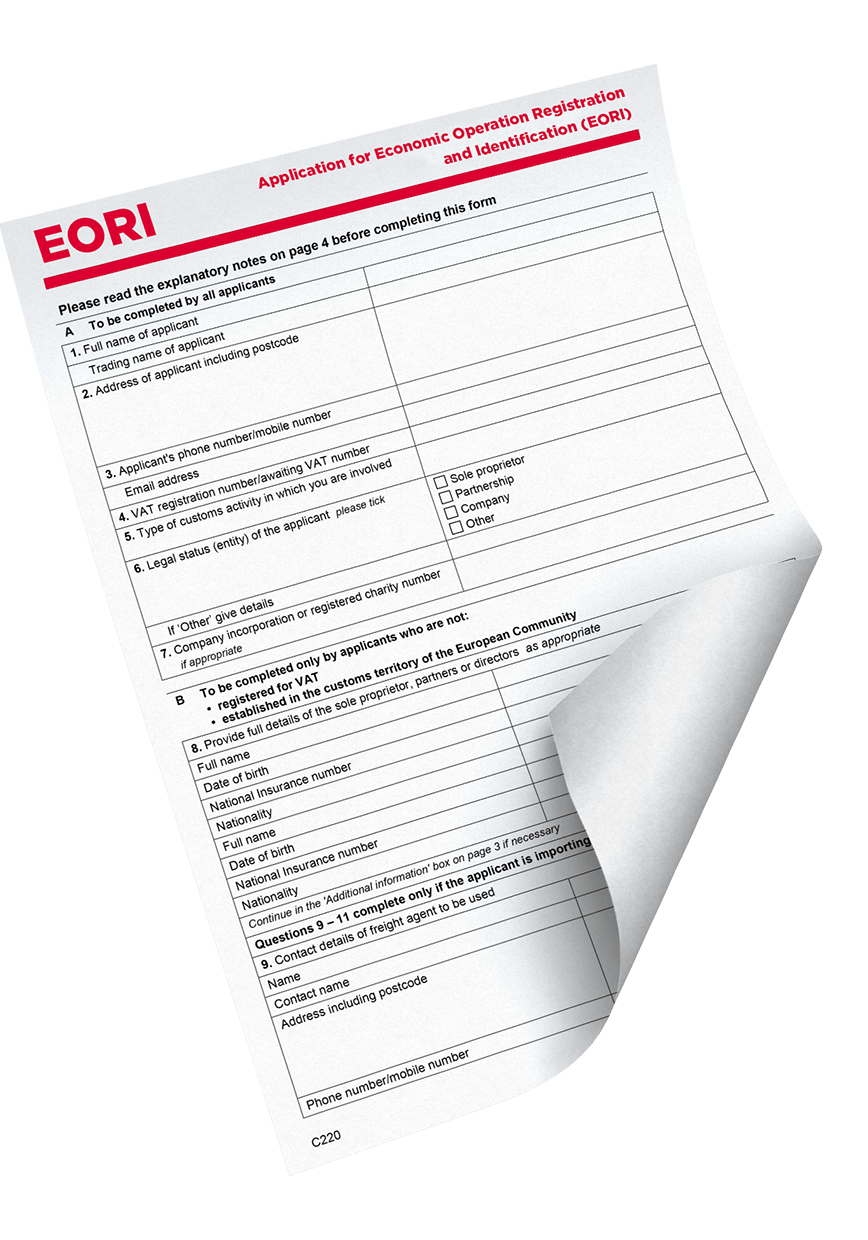

1. Apply for an EORI number if you do not currently ship goods outside the EU.

EORI stands for Economic Operators Registration and Identification number. Registration for the EORI is straightforward. For ROI VAT registered customers, this can be done via the ROS site. Revenue has a guide on their site to show you exactly what to do. It can take up to 3 days for this EORI number to be live. You will not be able to create shipments to locations outside the EU without this. Nor will you be able to ship from outside the EU into the EU.

Note - UK VAT:

- Irish Businesses sending goods to customers will have to register for UK VAT and charge VAT at Basket for goods with an invoice value of less than £135

- 2B consignments where UK business is not VAT registered or does not provide the UK VAT number at sale, Irish business charges VAT at Basket

- 2B consignments where UK business is VAT registered and provides UK VAT number at sale, Irish business does NOT charge VAT at sale. UK business will pay their VAT as part of their normal VAT payment

2. Get your Description of Goods, Country of Origin and Harmonisation Codes! If you have a number of different products to sell, start compiling harmonisation codes now.

Here is a link for the Taric site for ROI customers. You need these codes to ship goods outside the EU or from outside the EU into the EU. You will not be able to ship with DPD without these.

The HMRC has released a tool to help find the HS codes for import into the UK and to know the VAT and duty for that HS code that will be due on import into the UK. For ROI customers click here.

You can also find information as to how to find and obtain your HS codes here.

DPD will not carry goods that require checks at the Border, including food items and goods of plant and/or animal origin. Please see the list of prohibited and restricted goods.

Shipping Multi-parcel Consignments

For customs clearance purposes, all multi-parcel shipments must be declared together to Revenue and shipped together therefore you need to ensure that the number of parcels manifested on a consignment is the number of parcels shipped and received into Athlone.

3. Ensure that you are capturing email and mobile numbers for all of your consignees. Why?

As this information will be critical to each shipment travelling between Ireland and GB and GB and Ireland. The contact details will be used to communicate with your customers to make them aware of any taxes and duties payable. If we don’t receive these details in the consignment information, we will not be able to process the shipment.

For goods travelling from Northern Ireland, as part of the Northern Ireland Protocol and Withdrawal Agreement, for the vast majority of goods travelling from Northern Ireland to Great Britain, no customs formalities will be required from January 1st 2021. This means DPD Ireland will NOT ask for any customs details from you for your goods travelling from NI to GB, ROI or EU.

Note: We want to remind you that if you are shipping to consumers (i.e. not a business) in GB, you should have a GB VAT number. If you don't have one, please make sure to apply for one today. Click here to apply. You'll find all the details you need on the HMRC website available here.

For any customs related queries, you can contact customs.team@dpd.ie